operating cash flow ratio ideal

Operating cash flow ratio Operating cash flow Current liabilities. Start by calculating your incoming cashyour CFO.

As you can see theres nothing complex here simply divide cash flow from operations by current liabilities and youll have an answer.

. Hence with the operating cash flow ratio formula. How to Calculate the Operating Cash Flow Ratio. If it is higher the company generates more cash than it needs to pay off current liabilities.

This may signal a need for more capital. To arrive at the operating cash flow margin this number is divided by. The figure for sales revenue can be found in the.

If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities. These methods are needed to keep from having to pay for expensive additional funding when cash requirements exceed the amount of cash on hand. Lets take each component individually to understand what number needs to be plugged in.

Since the ratio is lower than 1 it indicates that Bower Technologies has a weak financial standing or is incapable of paying off short-term liabilities at this point. A higher ratio is more desirable. The operating cash flow ratio for Walmart is 036 or 278 billion divided by 775 billion.

Thus investors and analysts typically prefer higher operating cash flow ratios. It measures the amount of operating cash flow generated per share of stock. There are several ways to improve the cash flows generated by the operations of a business.

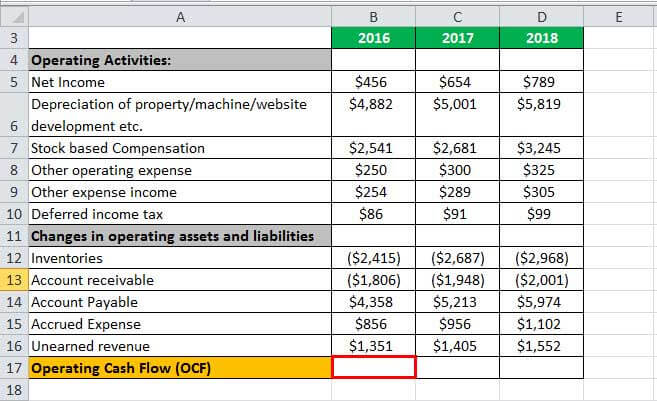

You can work out the operating cash flow ratio like so. A ratio higher than 1 is considered positive and favoured by investors analysts and creditors as it shows the company is pretty strong with enough money to pay off its current liabilities and have more capital left. To find the operating cash we can add the net income 3000000 depreciation 3000000 amortization 250000 change in working capital 80000 and other non-cash expenses 80000.

The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. Net sales 5400000. Below 1 indicates that firms current liabilities are not covered by the cash generated from its operations.

Operating cash flow ratio operating cash flow current liabilities Operating cash flow ratio 08 By inputting values into the formula the financial analyst finds that the company has an operating cash flow ratio of 08. Operating cash flow 3410000. When the operating cash ratio example is lower than 1 the business generates less cash than expected to repay the short-term liabilities.

Thus in this case the operating cash flow to sales ratio must be 75 or close. The key here is to focus on your companys regular business operations. The ideal ratio is close to one.

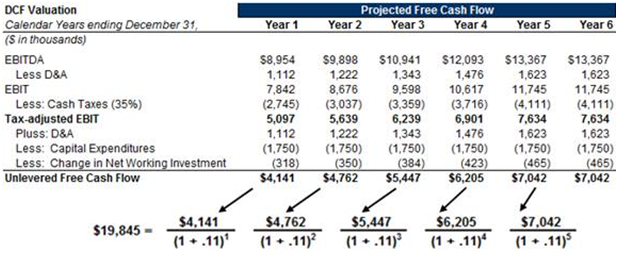

Ideally the projects that a company chooses to pursue show a positive NPV even with worst-case assumptions regarding the discount rate used the tax rate or revenue growth rate. Now we have both of our required variables. However they have current liabilities of 120000.

The Formula to Calculate the Operating Cash Flow Ratio. The formula is. The operating cash flow ratio also known as the Cash Ratio or Cash Flow Ratio ascertains if the cash flows obtained from the operations of a firm are adequate to cover the current liabilities.

This means that Company A earns 208 from operating activities per every 1 of current liabilities. The calculation of the operating cash flow ratio first calls for the derivation of cash flow from operations which requires the following calculation. The figure for operating cash flows can be found in the statement of cash flows.

This ratio can be calculated from the following formula. The operating cash flow ratio is a measure of a companys liquidity. A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate.

The formula for your operating cash flow ratio is a simple one. Companies with a high or uptrending operating cash flow are generally considered to be in good financial health. It is also sometimes described as cash flows from operating activities in the statement of cash flows.

The CAPEX to Operating Cash Ratio is a financial risk ratio that assesses how much emphasis a company is placing upon investing in capital-intensive projects. Now let us consider another example. Now that we have all the data needed to.

Examine accounts receivable to see if there are any overdue invoices. Cash Flow From Operating Activities 2100000 110000 130000 55000 1300000 - 1000000 2695000. Operating cash flow ratio CFO Current liabilities.

This is because it shows a better ability to cover current liabilities using the money generated in the same period. CFO CL OCF Ratio. So a ratio of 1 above is within the desirable range.

Now that we know about two components associated with the operating cash flow ratio its time to learn the equation. Operating Cash Flow Ratio Operating cash flow Current Liabilities¹ ². Essentially Company A can cover their current liabilities 208x over.

OCR Ratio Cash flow from operating activities Current liabilities 872 975 089. 250000 120000 208. For instance if 90 days receivables are outstanding it means on an average the company extends credit for 90360 25 of its sales at any given point of time.

Operating Cash Flow Ratio Operating cash flow Current Liabilities. Low cash flow from operations ratio ie. Income from operations Non-cash expenses - Non-cash revenue Cash flow from operations.

This ratio is generally accepted as being more reliable than the priceearnings ratio as it is harder for false internal adjustments to be made. This makes the analysts more sure that the financial statements of the firm are indeed genuine. There is no standard guideline for operating cash flow ratio it is always good to cover 100 of firms current liabilities with cash generated from operations.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. It brings a need for more capital. Targets operating cash flow ratio works out to.

A ratio of more than one indicates good financial health as it implies cash flow that is more than adequate to pay short-term financial obligations. Operating cash flow is the cash generated. Here is the formula for calculating the operating cash flow ratio.

Cash Flow from Operations CFO divided by Current Liabilities CL or. A ratio of less than one suggests short-term cash flow concerns. A higher ratio greater than 10 is preferred by investors creditors and analysts as it means a company can cover its current short-term liabilities and still have earnings left over.

Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth.

Operating Cash Flow Definition Formula And Examples

Cash Flow From Operations Ratio Formula Examples

Price To Cash Flow Ratio P Cf Formula And Calculation

Free Cash Flow Formula Calculator Excel Template

Operating Cash Flow Formula Calculation With Examples

Operating Cash Flow Formula Calculation With Examples

Cash Flow Ratios Calculator Double Entry Bookkeeping

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Formula How To Calculate Cash Flow With Examples

The 3 Most Important Financial Kpis To Manage Your Cash Flow Small Business Decisions

Price To Cash Flow Formula Example Calculate P Cf Ratio

Operating Cash Flow Ratio India Dictionary

Is Your Cash Working For You Open Forum Become The Best In The Business By Recruiting The Best Tech Talent Recruiting For Good Can Help Email Us At Carlos Recruitingforgood Com

Operating Cash Flow Ratio Definition Formula Example

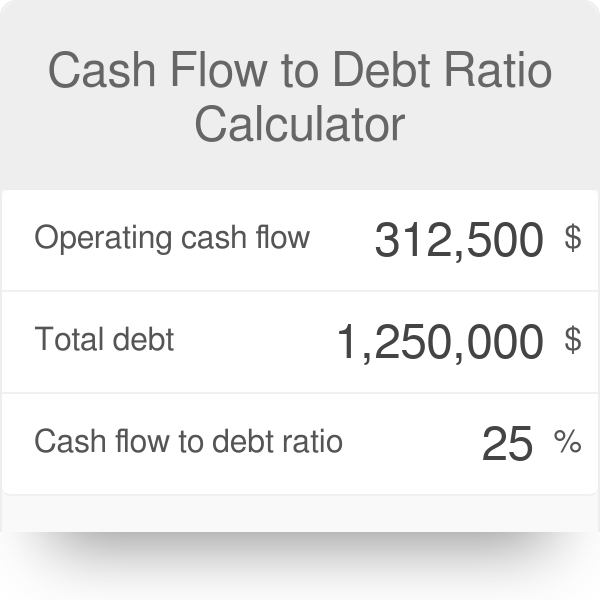

Cash Flow To Debt Ratio Calculator

Cash Conversion Ratio Financial Edge

Cash Flow To Debt Ratio Meaning Importance Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)